Are you considering the switch to solar energy for your home but hesitant about the upfront investment? One of the most compelling reasons for going solar is the impact it could have on your home's resale value. For homeowners and real estate investors looking to enhance their properties, tapping into the solar marketplace not only increases the eco-friendliness of your home but can also add significant financial value.

In this article, we explore the implications that investing in solar technology has on home resale values, and how this is benefiting homeowners as well as the environment.

No. 1

The Solar Resale Premium — Is It Real?

When considering home renovations, it's essential to weigh the financial impact against the costs. The case for solar is strong because, according to multiple studies, homes with solar panel installations tend to sell for more than those without. In a 2015 study conducted by the Lawrence Berkeley National Laboratory, it was found that homebuyers are willing to pay a sizable premium for homes with solar photovoltaic (PV) systems. On average, that premium was around $15,000 for a typical home.

In places like Calgary, it’s always a plus for a home to have solar panels installed. If you’re considering getting a house or have a property in Calgary and want a sustainable form of energy for it, Calgary Solar Power can help you with all your needs.

No. 2

Understanding the Appraisal Process

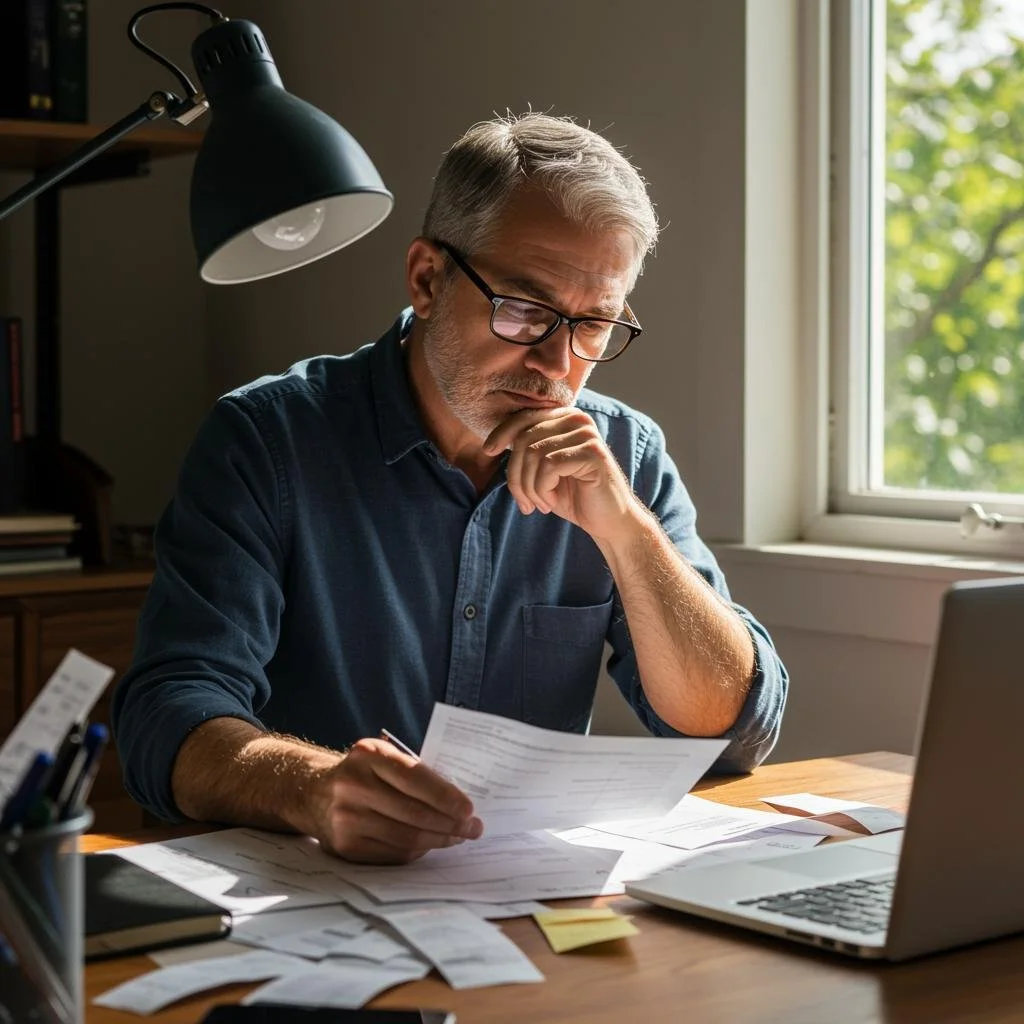

To make the most of your solar investment when selling, it's crucial to understand the appraisal process. The value of your solar system is determined based on the property's market value, which can increase due to savings on utility bills, tax credits, and other financial incentives. Appraisers typically use one of three methods to assess the value of solar panel systems: the cost approach, the income approach, and the market comparison approach.

Cost Approach - Carefully evaluates the cost of the installation and compares it to the future benefits of energy savings.

Income Approach - Takes into account the savings from your reduced energy bills over time as a form of income, for a net present value of these savings.

Market Comparison - Looks at the sales prices of similar homes with and without solar systems in the area to determine the value that solar is likely to add in the local market.

No. 3

Solar Panels as a Market Differentiator

In a competitive real estate market, solar panels can act as a significant differentiator for your property. More buyers are becoming increasingly interested in energy efficiency and sustainability. Solar panels offer a clear way for properties to stand out as modern, environmentally conscious, and cost-efficient—particularly given the rising energy costs. They can also serve as a long-term solution to attract buyers who are looking to cut down on their electricity expenses.

No. 4

The Role of Solar in Homebuyer Psychology

Selling a home with solar technology isn't just about the numbers; there's also a psychological aspect that can help sway buyers. Solar panels often signal a well-maintained property with a future-focused owner. The sight of solar panels during a home showing communicates that the home is equipped with long-term infrastructure that lowers operating costs and reduces the carbon footprint—qualities that are highly desirable for many modern homebuyers.

No. 5

Solar ROI and Quick Home Sales

A primary concern for people selling their homes is often the time it takes to make a sale. Homes equipped with solar panels enjoy higher chances of selling faster. A reduced energy bill is a tangible benefit for buyers, giving solar-equipped homes an edge over others in the market. With a quicker sale, the return on investment for your solar panel system is not only in its added value but also in the expedited sale process.

Takeaways

Ultimately, the data is clear — solar power stands as one of the few home upgrades that will likely pay for itself and then some. The value addition is not just monetary; it's a bet on a more sustainable, efficient, and forward-thinking living. Whether you're investing for the future, the planet, or your equity, going solar is a win-win that illuminates the path to a brighter, greener home future.